Are consumers all set for meat grown in a lab?

< img aria-describedby ="caption-attachment-1895205" class ="breakout size-full wp-image-1895205"title="Future Meat leadership "&src=" https://techcrunch.com/wp-content/uploads/2019/10/Future-Meat-leadership.jpg "alt=" Future Meat leadership"width= "1024"height= "683"srcset="https://techcrunch.com/wp-content/uploads/2019/10/Future-Meat-leadership.jpg 2500w, https://techcrunch.com/wp-content/uploads/2019/10/Future-Meat-leadership.jpg?resize=150,100 150w, https://techcrunch.com/wp-content/uploads/2019/10/Future-Meat-leadership.jpg?resize=300,200 300w, https://techcrunch.com/wp-content/uploads/2019/10/Future-Meat-leadership.jpg?resize=768,512 768w, https://techcrunch.com/wp-content/uploads/2019/10/Future-Meat-leadership.jpg?resize=680,453 680w, https://techcrunch.com/wp-content/uploads/2019/10/Future-Meat-leadership.jpg?resize=50,33 50w"sizes=

“With this financial investment, we’re delighted to bring cultured meat from the laboratory to the factory flooring and begin working with our industrial partners to bring our product to market,” said Rom Kshuk, the ceo of Future Meat Technologies, in a declaration. “We’re not just developing an international network of financiers and advisors with knowledge across the meat and ingredient supply chains, but likewise offering the company with adequate runway to accomplish commercially viable production expenses within the next two years.”

The $10 cost is a lot lower than the$50 target that professionals from the Good Food Institute were speaking about back in April of this year– and represents a substantial expense reduction that makes lab-grown meat a potentially commercially practical option much sooner than anybody expected.

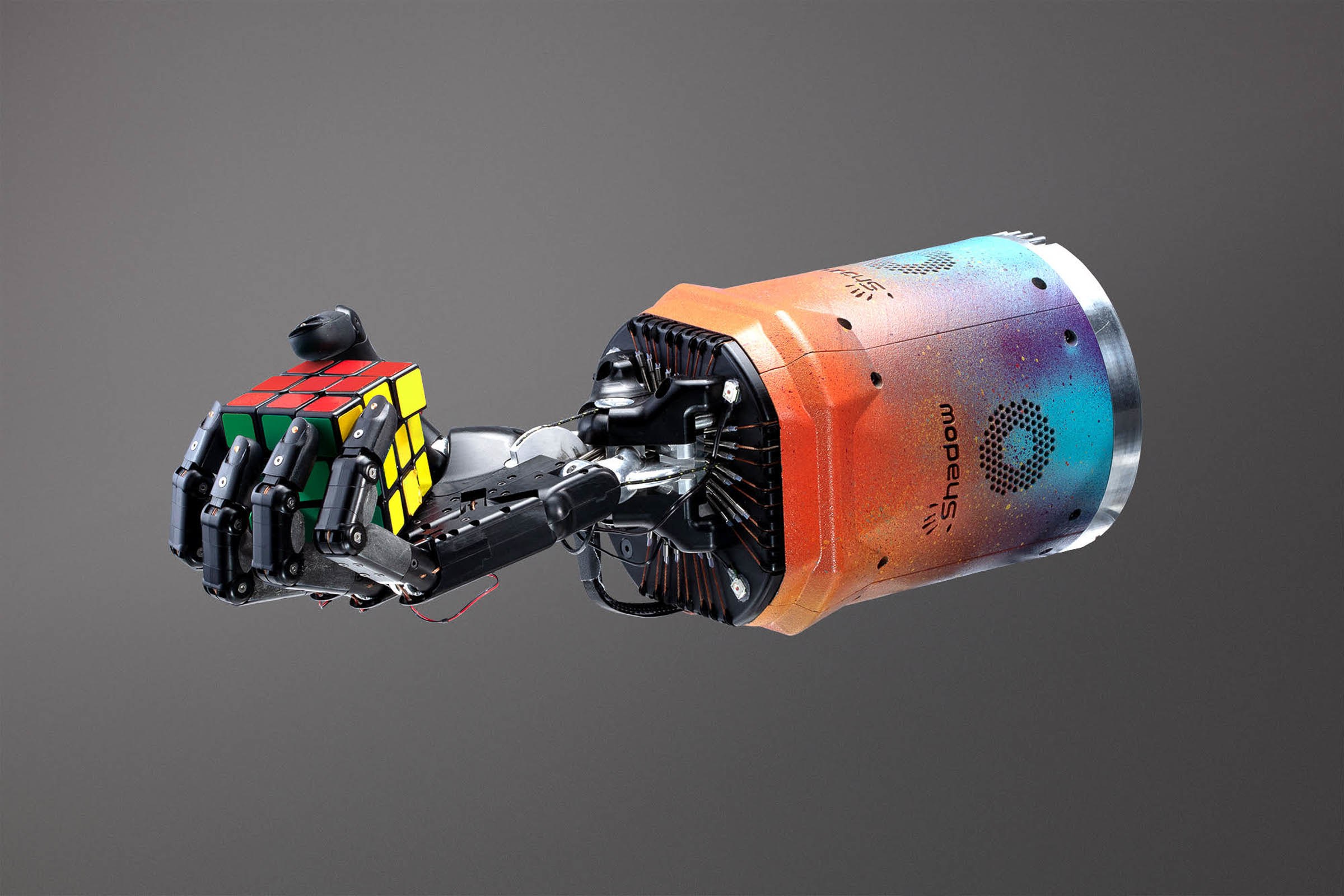

“(max-width: 1024px)100vw, 1024px”> Future Meat management, Dr. Moria Shimoni, EVP of R&D; Yaakov Nahmias, CTO and founder; and Rom Kshuk, CEO”You’re either growing fat or you’re growing muscle of a specific species,”says Nahmias. “Imagine a big truck going to that center. [It’s] changing the meat packaging plant. From there the biomass goes through a process like extrusion. You can have countless these standardizing systems. [It’s] going to a central center where the meat comes out at the end. What we are doing is trying to find parity and expense.”

With the new financing from investors– including S2G Ventures, a Chicago-based endeavor firm (and an early financier in Beyond Meat); Emerald Technology Ventures, a Swiss financial investment firm; Tyson Ventures (one of the most active strategic financiers); and Bits x Bites (a Chinese investor in food and farming start-ups)– Future Meat can now test its company design and manufacturing abilities at scale.

Now, Future Meat Technologies has actually raised $14 million in brand-new funding to develop its very first pilot production facilities to bring the cost of production of a cell-made steak to $10 per pound– or $4 if the meat is combined with plant-based meat alternatives.

The previous Hebrew University of Jerusalem teacher first began considering the lab-grown meat service while on sabbatical. “It was at a Peet’s Coffee right next to the Charles River in Cambridge,” Nahmias recalled. “Somebody asked me what I thought about cultured meat … They asked me what I considered it and I told them it was the stupidest idea I had actually ever heard in my whole life.”

been an obstacle to growth at large scales, according to chief science officer and founder Yaakov Nahmias. While Future Meat does not count on fetal bovine serum to grow its meat products, it does use little particles originated from CHO cells (Chinese hamster ovaries), which are used in new medical research and drug production.

Eventually the objective is getting to cost parity with routine beef. The business thinks a hybrid product could be $3 to $4, while the 100% biomass product would be roughly $10.

Nahmias visualizes products that are used a mix of Future Meat’s lab-grown items and plant proteins that can approximate the complete flavors of chicken, beef or lamb (all meats that the company says it is working with).

Nahmias states utilizing a refrigerator-sized bioreactor, a manufacturer might get about half a heap of meat and fat in about 14 days. In about one month, growers can make an amount of meat equivalent of 2 cows’ worth of meat (a cow takes about 12 to 18 months to raise for slaughter).

Unlike its other competitors, Future Meat Technologies does not have any interest in selling its items directly to customers. Rather, the business desires to be the provider of the hardware and cell lines that anyone would require to end up being a maker of lab-grown meat.

Nahmias and Kshuk believe that’s the role Future Meat Technologies was born to play.

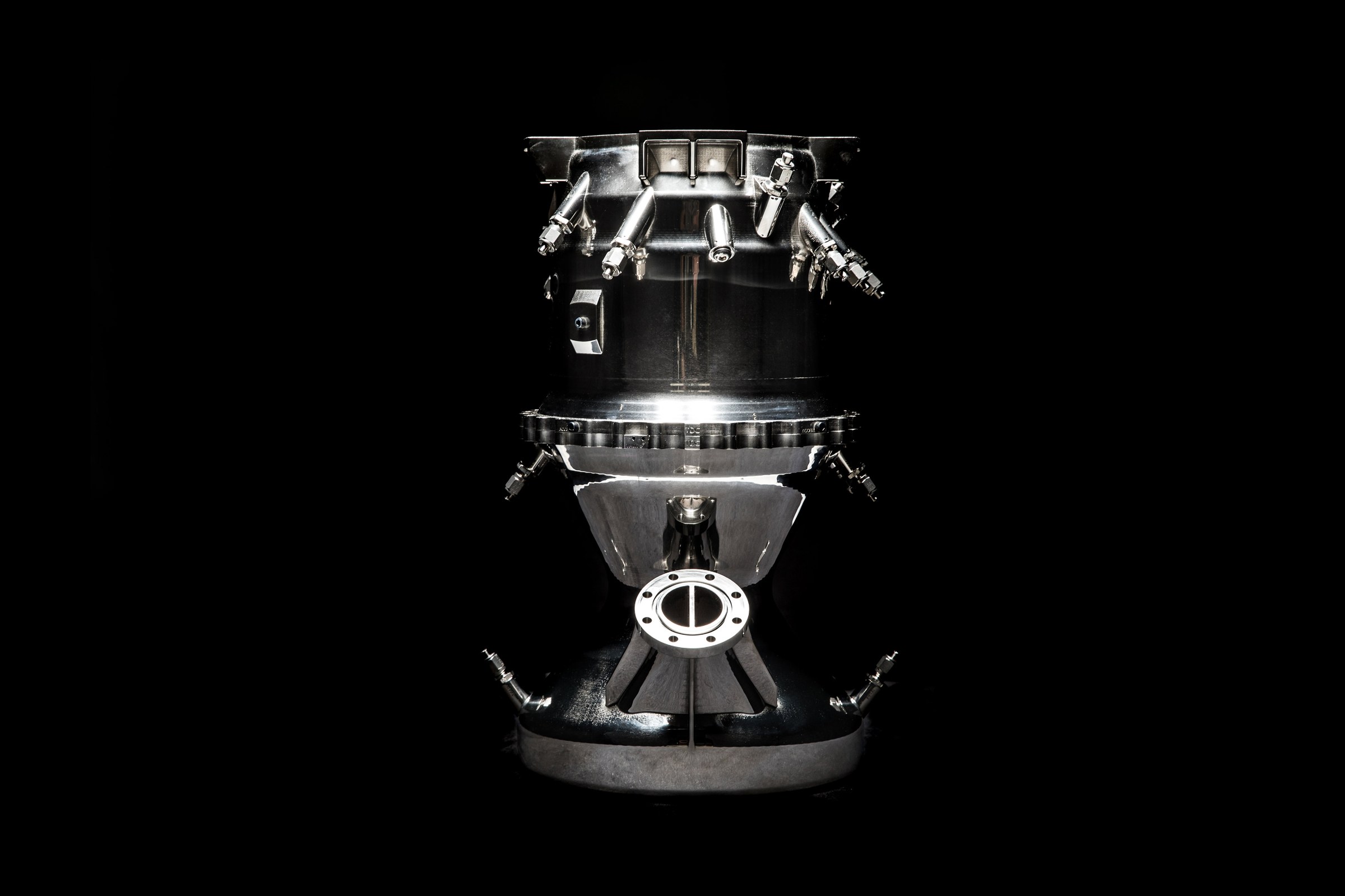

“We have a particular resin to get rid of the contaminants from the media and that allows the cells to continue to grow,” says Nahmias. “It is basically a brand-new bioreactor design … you can increase the yield to 80%. For every single liter of medium you don’t get 100 grams of biomass you can get 800 grams of biomass … [and] you don’t speak about mega $100 million factories.”

Like all of the other companies pursuing alternatives to animal husbandry, Future Meat, which was only founded in 2015, has a mission to reduce the ecological effect of meat eating. The company argues that its production design will minimize land usage by 99% and release 80% less greenhouse gas than conventional meat production.

“This continues our investment in Future Meat Technologies, which is focused on disruptive technologies related to our core organisation,” stated Amy Tu, president of Tyson Ventures, in a declaration. “We are widening our exposure to alternative methods of producing protein to feed a growing world population.”

Growing cells is costly, Nahmias stated at the time, and the fact that the organisms essentially grow in their own excrement indicates that they can’t replicate effectively to reach any sort of big scale. That’s when Nahmias had his “Eureka” moment. “You require cells that grow without any development factor at all,” says Nahmias. “The only cells that can do that are the least distinguished cells, which are fibroblasts.”

Business like Memphis Meats, Aleph Farms, Higher Steaks, Mosa Meat and Meatable are all attempting to bring to grocery stores around the globe meat made from cultivated animal cells, however the issue has always been the expense.

“We’re taking a yes and ‘Yes and’ as opposed to an either-or approach to the area,” states Matthew Walker, a handling director at S2G Ventures. “You will have animal-based meat, plant-based meat and you will have hybrid products. It’s more about the supply chain and the technological products that would bring this product to market. We believe there’s room in the market for somebody to play that role.”

All Nahmias wants is for Future Meat to get to market; the founder doesn’t care whether that’s under Tyson’s brand name or anyone else’s. “I wish to be the biggest business you’ve never become aware of,” states Nahmias. “I wish to make an item that is more sustainable and more cost-effective, and is much better for everybody.”

In a manner, it’s very little various to the technique that Tyson Foods– a financier in Future Meat through its endeavor capital arm– has actually taken with farmers. Tyson contracts with poultry farmers to raise the chickens that the business slaughters and processes, and provides them with the means to raise the chickens for slaughter. Future Meat production tanks for meat and fat The secret to Future Meat’s success is its usage of undifferentiated fibroblast cells that can be set off with small molecules to become either fat cells or muscle cells. Once the fat and muscle starts growing, they’re positioned in a culture with a specific resin that removes waste materials that have

For Nahmias, the fat’s the important things that brings the taste for everything. “The fat gives you the fragrance and the unique flavor of meat,” says Nahmias. “This is the missing component in Impossible Foods and Beyond Meat .”