“We’ve been able to figure out how to dependably and at scale cut, joint together in a pumpkin shape, wrap up, stuff in a giant box, and ship balloons throughout the nation to our launch websites,” Candido wrote. And when they do fly, Google keeps track of “hundreds of telemetry information streams related to flight system performance,” changing ballast and other criteria to take full advantage of flight time. All of that work means the Loon balloons can remain aloft longer, reducing flight costs per hour.

With the PlayStation 5 set to launch in a couple of weeks, typically you ‘d expect a significant unfavorable impact on Sony’s books for the previous quarter as the company ramps up manufacturing prior to it begins to bring in more earnings. Sony does say that its earnings were hit by an increase in costs, while earnings was minimized by a foreseeable decrease in PS4 sales. That ‘d be a 26 percent increase in both revenue and profit, which would be outstanding for the very first year of a console cycle.

With the PlayStation 5 set to launch in a couple of weeks, typically you ‘d anticipate a considerable negative impact on Sony’s books for the previous quarter as the business increases production prior to it starts to generate more earnings. Sony does state that its profits were hit by an increase in expenses, while revenue was decreased by a foreseeable decrease in PS4 sales. Higher game software sales and PlayStation Plus subscriptions, nevertheless, more than comprised the shortage.

make 2.6 trillion yen in revenue and 300 billion yen in revenue by the end of March 31st. That ‘d be a 26 percent increase in both earnings and profit, which would be outstanding for the first year of a console cycle. Sony’s earnings is likely to be restricted in the short-term by the number of PS5 consoles

it’s able to produce. In an interview with Reuters today, SIE chief Jim Ryan said there was “very significant demand”for the device, which he states was preordered in the United States more times in its very first 12 hours than the PS4 was in its very first 12 weeks.”It may well be that not everyone who wants to buy a PS5 on launch day will be able to find one.”

Ghost of Tsushima is now PS4’s fastest selling first-party initial IP debut with more than 2.4 million units offered through globally in its very first 3 days of sales.

Congratulations @SuckerPunchProd, and thank you to fans around the globe for taking part in Jin’s journey. pic.twitter.com/6aE4U7YZJH!.?.!— PlayStation(@PlayStation)July 24, 2020 Sony has actually now modified its full-year gaming projection upward somewhat, expecting to

Sony’s video gaming department is continuing to drive significant profits for the business even as the PlayStation 4 period winds down. The company announced PlayStation-related income of 507 billion yen (~$4.9 billion) and an operating revenue of 105 billion yen (~$1 billion) for its July-September quarter, respective improvements of 52 and 40 percent on the same duration a year earlier.

Sony’s big PS4 release for the quarter was the open-world samurai experience Ghost of Tsushima, which came out in July and sold 2.4 million copies in its very first 3 days. Sony says it’s the fastest-selling new IP on the platform.

Using ribbons to produce its wafers, Leading Edge’s production equipment utilizes the floating silicon approach to reduce production to a single action, consuming less energy and producing almost no waste, according to the business.

Kellerman, now the emeritus chief innovation officer, was changed by Nathan Stoddard, a seasoned silicon manufacturing technology expert who has dealt with teams that have brought 3 different solar wafer technologies from concept to pilot production. Stoddard, a former associate of Greenlee’s at 1366– among the early companies dedicated to brand-new silicon production technologies– was won over by Greenlee and Kellerman’s belief in the old Applied Materials technology.

Silicon wafer production today is a seven-step procedure in which large silicon ingots created in greatly energy-intensive furnaces are sawed into wafers by wires. The procedure wastes big quantities of silicon, requires an amazing quantity of energy and produces low-quality wafers that decrease the performance of photovoltaic panels.

Leading Edge expects that its devices might become the standard for silicon substrate production.

The company declares that its technology can decrease wafer costs by 50 percent, increases industrial photovoltaic panel power by as much as 7 percent, and decreases production emissions by over 50 percent.

The $7.6 million financing came from Prime Impact Fund, Clean Energy Ventures and DSM Venturing and the business said it would use the technology to increase its sales and marketing efforts.

Established by longtime experts in the silicon foundry industry– Alison Greenlee, a quadruple-degreed graduate of the Massachusetts Institute of Technology who dealt with floating silicon method that minimizes waste in the production of silicon for solar cells; and Peter Kellerman, the progenitor of floating silicon approach innovations.

“After vital innovation demonstrations and the advancement of a new commercial tool, we are now all set to launch this technology into market in 2021,” said Schwerdtfeger in a statement. “Having just recently secured a 31,000 square foot facility and doubled the size of our team, we will use this new financing to prepare for our 2021 commercial pilots.”

The 2 won $5 million in federal grants and raised an initial $6 million from endeavor capital companies in 2018 to kick off the innovation.

Only a couple of weeks after the effective public offering of Array Technologies proved that there’s a market for innovations aimed at improving efficiencies throughout the solar production and installation chain, Leading Edge Equipment has raised capital for its novel silicon wafer manufacturing devices.

For the last couple of years researchers have been talking up the potential of so-called kerfless, single-crystal silicon wafers. For industry watchers, the poly-crystalline versus single-crystal wafers may sound familiar, but as with many things with the revival of climate technology investment maybe this time will be various.

The 2 founded Leading Edge Equipment to renew a task that had actually been mothballed by Applied Materials after years of research.

To advertise the project, previously this year the group brought in Rick Schwerdtfeger, a long time innovator in solar technology who began dealing with CIGS crystals back in 1995. In the 2000s Schwerdtfeger invested his time in building out ARC Energy to scale next-generation heater innovations.

For the last couple of years researchers have been talking up the potential of so-called kerfless, single-crystal silicon wafers. To advertise the job, previously this year the group brought in Rick Schwerdtfeger, a long time innovator in solar technology who began working with CIGS crystals back in 1995.”After crucial technology demonstrations and the development of a brand-new business tool, we are now prepared to introduce this innovation into market in 2021,” said Schwerdtfeger in a declaration.

On the other hand startups like Lucid Motors are proving that they might be serious competitors to Tesla’s market supremacy. Lucid’s recent rates for its Air sedan sufficed to force Tesla president and head of public relations, Elon Musk, to parry back with a (creatively picked) rate cut on the business’s own models.

Profits grew 30% year-on-year, something the company credited to significant growth in car shipments, and running earnings likewise grew to $809 million, showing improving running margins to 9.2%.

And the solar service is likewise enhancing, according to Tesla. “Our just recently introduced strategy of inexpensive solar (at $1.49/ watt in the U.S. after tax credit) is beginning to have an effect. Overall solar implementations more than doubled in Q3, to 57 MW compared to the prior quarter, with Solar Roof deployments almost tripling sequentially.”

Operating expenses for the company were likewise up. New factories in Austin and Brandenburg, Germany imply extra expenditures, and Tesla put $1.25 billion into operations, up 33% from the previous quarter.

This story is establishing and will be updated.

Energy storage reached a business record 759 Megawatt hours in the quarter, and the company stated that megapack production for its large-scale batteries is growing while Powerwall need stays strong.

Now we have the response, as Tesla reported earnings of $331 million * on incomes of $8.77 billion for the third quarter. That’s up 39% from the year-ago period. Wall Street had actually expected $8.36 billion in earnings for the quarter, according to estimates published by CNBC.

Tesla’s most current quarterly numbers beat expert expectations on both profits and earnings per share, generating $8.77 billion in profits for the third quarter.

The delivery beat marked a 43% enhancement from the same quarter in 2015, when the business reported shipments of 97,000 electric automobiles. And delivery numbers were up 53% quarter on quarter, as the worldwide spreading COVID-19 pandemic took its toll on sales and production operations for Tesla at its main U.S. factory.

“We continue to think that the energy business will ultimately be as big as our vehicle company,” the company said.

With the report that Tesla had already beaten Wall Street’s expectations for shipments earlier this month, the concern for today’s profits call was just how much efficiency (and by extension, earnings) the electric car and battery company was able to wring out of its manufacturing processes.

And while the automotive business is plainly still the star of the show, both Tesla’s solar and storage services revealed marked improvements in the third quarter.

Tesla’s incomes beat comes in the middle of mounting competitors from some of the world’s biggest car manufacturers. The other day GMC unveiled its Hummer EV and, in September, Ford revealed that it would be slashing the rate on its Mustang Mach E to “stay fully competitive.”

The quarter also saw Tesla reveal a sweeping new vision for its battery manufacturing plans. Throughout the investor discussion Tesla chief executive Elon Musk said that he anticipated to provide up to 40% more electric lorries than in 2019 and set out the plan for much better battery manufacturing effectiveness.

Earlier this month, the company tipped its hand on fortunately around deliveries, saying that it had actually currently provided 139,300 automobiles in the third quarter, somewhat above Wall Street’s expectations, and a significant enhancement from last quarter, as well as the exact same period a year ago.

And the solar company is also enhancing, according to Tesla. Operating costs for the company were also up. The delivery beat marked a 43% improvement from the same quarter last year, when the business reported deliveries of 97,000 electrical vehicles. The quarter also saw Tesla reveal a sweeping brand-new vision for its battery production strategies. Tesla’s incomes beat comes amidst mounting competitors from some of the world’s biggest automakers.

Customer samples for these new chips are anticipated to get here in the very first quarter next year, with scale manufacturing in the second quarter.

While there has been a wave of brand-new chip startups like Cerebras, SiFive, and Nuvia moneyed by investor in the previous two years, Flex Logix got its footing a bit previously. The business, established in 2014 by previous Rambus creator Geoff Tate and Cheng Wang, has jointly raised $27 million from financiers Lux Capital and Eclipse Ventures, in addition to Tate himself.

“Every client we talk to desires more processing power per dollar, more processing power per system of power … and with our die-size advantage we can provide them more for their money,” Tate discussed.

However here is the X1. Photo via Flex Logix. The reason those chips are cheaper is that they are considerably smaller than contending chips from Nvidia in its Jetson chip lineup according to Tate, as much as 1/7 the size. Smaller chips typically have lower costs, considering that each wafer in a chip fab can hold more chips, amortizing the cost of production over more chips. According to the business, its chips outperform Nvidia’s Xavier module, although independent criteria aren’t readily available.

In the first couple of years of the company, it focused on developing and licensing IP around FPGAs, or reprogrammable chips that can be altered after producing through software application. These versatile chips are vital in applications like AI or 5G, where designs and standards alter quickly. It’s a market that is dominated by Xilinx and Altera, which was acquired by Intel for $16.7 billion back in 2015.

Flex Logix saw an opportunity to be “the ARM of FPGAs” by helping other business develop their own chips. It developed customer traction for its styles with organizations like Sandia National Laboratory, the Department of Defense and Boeing. More recently, it has been developing its own line of chips called InferX X1, developing a hybrid service design not unlike the design that Nvidia will have after its acquisition of ARM clears through regulative difficulties.

In the computing world, there are most likely more kinds of chips offered than your local supermarket snack aisle. Diverse computing environments (data centers and the cloud, edge, mobile devices, IoT, and more), different cost points, and varying abilities and efficiency requirements are scrambling the chip industry, resetting who has the lead right now and who might take the lead in brand-new and emerging niches.

Flex Logix wishes to bring AI processing workflows to the calculate edge, which suggests it desires to offer innovation that adds synthetic intelligence to items like medical imaging equipment and robotics. At the edge, processing power obviously matters, however so does size and cost. More efficient chips are much easier to consist of in products, where prices might put constraints on the expense of private parts.

The business’s strategy is to continue both sides of its organization and continue to grow and grow its technology. “Our ingrained FPGA companies is now, as a standalone, lucrative. The quantity of cash we’re bringing in surpasses the engineering and company. And now we’re establishing this brand-new organization for reasoning which eventually must be a larger organization because the market is growing extremely quick in the reasoning space,” Tate explained.

The company’s board consists of Peter Hébert and Shahin Farshchi of Lux, Pierre Lamond at Eclipse, and Kushagra Vaid, a distinguished engineer at Microsoft Azure. The business is based in Mountain View, California.

With that background out of the way, Flex Logix unveiled the accessibility of its X1 chip, which is presently slated to be used at 4 speeds varying from 533Mhz to 933Mhz. CEO Tate worried on our call that the company’s key differential is cost: those chips will be priced in between $99-$199 depending on chip speed for smaller sized orders, and $34-$69 per chip for large-scale orders.

It’s a chip, alright. Ain’t a lot of great stock art.

In the very first couple of years of the business, it focused on establishing and accrediting IP around FPGAs, or reprogrammable chips that can be altered after making through software. Flex Logix saw an opportunity to be “the ARM of FPGAs” by assisting other companies establish their own chips. It’s a chip, alright. The reason those chips are more affordable is that they are substantially smaller sized than completing chips from Nvidia in its Jetson chip lineup according to Tate, up to 1/7 the size. Smaller sized chips typically have lower expenses, considering that each wafer in a chip fab can hold more chips, amortizing the cost of production over more chips.

He concluded there are no strategies to draw out any organization, keeping in mind there’s no requirement to add intricacy.

Outside of car production, Musk points to insurance when asked about the growth potential. He says the insurance coverage business might grow into 30-40% of Tesla’s vehicle business.

According to Musk, a few of the so-called startups include autonomy, chip style, automobile service, sales, creating a drive system, motors, supercharger network and, quickly, insurance.

This method apparently works well for Tesla, which constantly rolls out updates to existing products at an uncommon pace. New functions arrive without much warning, and it makes sense when Tesla is dealing with different lorry element departments as a collection of companies rather of a collection of departments.

“The thing people do not understand about Tesla is [the company] is an entire chain of startups,” Musk said. “And then people state, ‘well, you didn’t do that previously.’ Yeah, well, we’re doing it now. I believe we might have been a bit slower than other start-ups, however I don’t believe we’ve truly had anything fail.”

In short, he described there are over a dozen start-ups in Tesla, and he views every line of product and plant as a startup. It’s an intriguing viewpoint from the top of Tesla, a cars and truck producing company that also develops batteries, house photovoltaic panels and, to name a few things, is looking to offer automobile insurance coverage, too.

Today throughout a call with investors and reporters, Tesla CEO Elon Musk was asked to expand a tweet from the other day. In it, he mentioned: “Tesla ought to actually be considered roughly a dozen technology startups, a number of which have little to no connection with traditional vehicle business.”

, Tesla CEO Elon Musk was asked to expand a tweet from yesterday. In brief, he described there are over a dozen startups in Tesla, and he sees every product line and plant as a start-up. This technique seemingly works well for Tesla, which continuously rolls out updates to existing items at an uncommon speed.

“Support” is translated broadly, though not necessarily overly so– it’s a standard model going back to the ’70s, a NASA representative discussed. On page 138 of the appendix (page 493 general), we find that NASA supports 66 jobs in the sheet metal manufacturing world, worth about $4 million in labor, including almost $6 million in worth itself, and producing an overall favorable economic effect of about $14 million. How does NASA support small arms manufacturing and produce a $4 million economic effect, or support the tortilla market to a comparable degree?

“Support” is interpreted broadly, though not necessarily extremely so– it’s a standard model going back to the ’70s, a NASA agent discussed. Essentially, NASA’s direct payroll and procurement budget plans are one thing, but they might lead to increased demand for items and services in general, and increased costs by business, customers and regional governments. On page 138 of the appendix (page 493 overall), we find that NASA supports 66 jobs in the sheet metal production world, worth about $4 million in labor, adding nearly $6 million in worth itself, and producing a total favorable economic impact of about $14 million. How does NASA support small arms manufacturing and produce a $4 million financial effect, or support the tortilla industry to a similar degree?

As companies manufacture goods, human inspectors review them for flaws. Consider a scratch on smartphone glass or a weak point in raw steel that might have an effect downstream when it gets turned into something else. Landing AI, the business started by previous Google and Baidu AI guru Andrew Ng, wishes to utilize AI innovation to recognize these flaws, and today the business released a new visual evaluation platform called LandingLens.

“We’re revealing LandingLens, which is an end-to-end visual examination platform to help producers construct and deploy visual evaluation systems [using AI],” Ng told TechCrunch.

Ng says to put this advanced innovation into the hands of these customers and use AI to visual inspection, his business has created a visual interface where business can resolve a defined process to train models to comprehend each client’s assessment requirements.

Ng says that his business is attempting to bring in sophisticated software application to assist resolve a big issue for manufacturing clients. “The bottleneck [for them] is constructing the deep knowing algorithm, really the artificial intelligence software application. They can take the picture and render judgment as to whether this part is all right, or whether it is defective, which’s what our platform helps with,” he said.

He states the company’s objective is to bring AI to producing companies, however he could not merely repackage what he had actually discovered at Google and Baidu, partially since it involved a various set of consumer usage cases, and partly due to the fact that there is just much less data to deal with in a production setting.

The producer develops what’s called a problem book, where the inspector specialists work together to determine what that defect looks like by means of a photo, and solve differences when they occur. All this is done through the LandingLens interface.

Including to the degree of problem here, each setting is unique, and there is no basic playbook you can necessarily use across each vertical. This meant Landing AI needed to come up with a basic tool set that each business might utilize for the special requirements of their production procedure.

Once inspectors have actually concurred upon a set of labels, they can start repeating on a model in the Model Iteration Module, where the company can train and run models to get to a state of agreed upon success where the AI is getting the defects regularly. As customers run these experiments, the software application generates a report on the state of the model, and clients can fine-tune the models as required based on the information in the report.

The way it works is you take pictures of what a great ended up product appears like, and what a defective item might look like. It’s not as simple as it might sound, because human experts can disagree over what constitutes a flaw.

He thinks this innovation could ultimately assist recast how products are made in the future. “I think deep knowing is poised to transform how evaluation is done, which is truly the key action. Examination is truly the last line of defense against quality defects in manufacturing. I’m thrilled to launch this platform to assist producers do assessments more precisely,” he said.

The maker develops what’s called a flaw book, where the inspector specialists work together to determine what that problem looks like through a picture, and deal with arguments when they occur. Once inspectors have actually agreed upon a set of labels, they can begin iterating on a model in the Model Iteration Module, where the business can train and run designs to get to a state of agreed upon success where the AI is choosing up the defects on a regular basis. Ng says that his business is trying to bring in sophisticated software to assist solve a huge issue for making clients. Assessment is actually the last line of defense versus quality problems in manufacturing.

“They simply generally severed ties with direct sales,” Andrus stated. The layoffs made up 13 percent of Quincy Bioscience’s personnel at the time, according to a complaint an employee submitted to the Wisconsin Attorney General’s Office, obtained by WIRED with a FOIA demand. (The state figured out that no offense took place.)

A half and a year later on, in November 2016, FDA inspectors observed a “visible reduction” in the variety of unfavorable event reports Quincy got after they stopped the calls. By that point, the business had actually received well over 4,000 reports from customers who stated they experienced health concerns after utilizing its products since they initially went on sale, according to the files WIRED obtained from the FDA.

To comprehend the meaning of that, the total number of people who took Prevagen must likewise be considered, Durkin stated. “For any specific situation the number of unfavorable events may sound high, but then you need to step back and say, OK, how many individuals really took the item and of that number what was the rate of adverse occasions,” he said. It’s uncertain how lots of people had taken Prevagen by 2016. That number has been estimated to be 3 million since 2020, by attorneys representing a Prevagen customer in Florida.

“The danger assessment that you perform in GRAS is for food usage. You’ve never ever taken a look at the safety of the supplement uses, however you’re using one to boot-strap the security of another,” said Laura MacCleery, policy director of the Center for Science in the general public Interest, a not-for-profit watchdog that advocates on behalf of customers on food-related issues. The Center for Science in the general public Interest is one of 5 companies currently taking legal action against the FDA over the legality of the existing guideline, which was settled in 2016.

The FDA maintains that it “can question the basis for an independent GRAS conclusion, whether informed or not,” or perhaps if the notification is withdrawn. And by 2016, the FDA was on Quincy’s case again. Internal e-mails exchanged by FDA employees that year, gotten by WIRED through FOIA, suggest that by then, a “synthetically produced item being marketed in the type of a shake” was under examination by the FDA as a possible unapproved food additive.

The agency sent a letter to Mark Underwood dated January 7, 2016, relating to NeuroShake’s component apoaequorin. “We are worried about the security of your apoaequorin products since of, among other things, the great deals of adverse occasions reported for them,” Steven Musser, the FDA’s deputy director for clinical operations, wrote. He noted that Quincy seemed opposing itself in its public declarations: The company’s GRAS self-determination discussed that apoaequorin was safe due to the fact that it was digested like other dietary proteins, but products marketing Prevagen claimed it could go through the gastrointestinal system and cross the blood-brain barrier. Musser asked Underwood to describe how both things could be true, and what evidence Quincy had that its component was both safe and efficient.

WIRED did not get any action the business sent out to the FDA about the letter from Musser under FOIA. When asked about the letter directly, the Quincy representative said, “Apoaequorin is GRAS, whether it is in a food like Neuroshake or a dietary supplement like Prevagen. And as previously stated, the FDA issued a close-out letter to Quincy Bioscience which the FDA only concerns when, based on its evaluation, the firm attended to the issues recognized in the Warning Letter to the FDA’s fulfillment.”

Over 4,000 complaints and counting

Quincy Bioscience’s NeuroShake relocation appears to have worked well for Quincy in one regard: When FDA detectives showed up in Wisconsin for another assessment in 2016, they were back to evaluating the business for supplement production practices, not drugs.

The business had actually undergone some changes, too. Throughout the previous assessment, Quincy management had attributed having a greater proportion of grievances than other manufacturers to all their outbound sales calls, due to the fact that throughout calls staff members would ask, “How are you feeling?” After the inspection, Quincy stopped its direct sales strategy and laid off members of its sales group, consisting of Shawn Andrus.

The FDA preserves that it “can question the basis for an independent GRAS conclusion, whether alerted or not,” or even if the notice is withdrawn. And by 2016, the FDA was on Quincy’s case again. “We are concerned about the safety of your apoaequorin products because of, amongst other things, the large numbers of negative events reported for them,” Steven Musser, the FDA’s deputy director for clinical operations, composed. WIRED did not acquire any reaction the company sent out to the FDA about the letter from Musser under FOIA. A half and a year later, in November 2016, FDA inspectors observed a “visible reduction” in the number of negative event reports Quincy got after they stopped the calls.

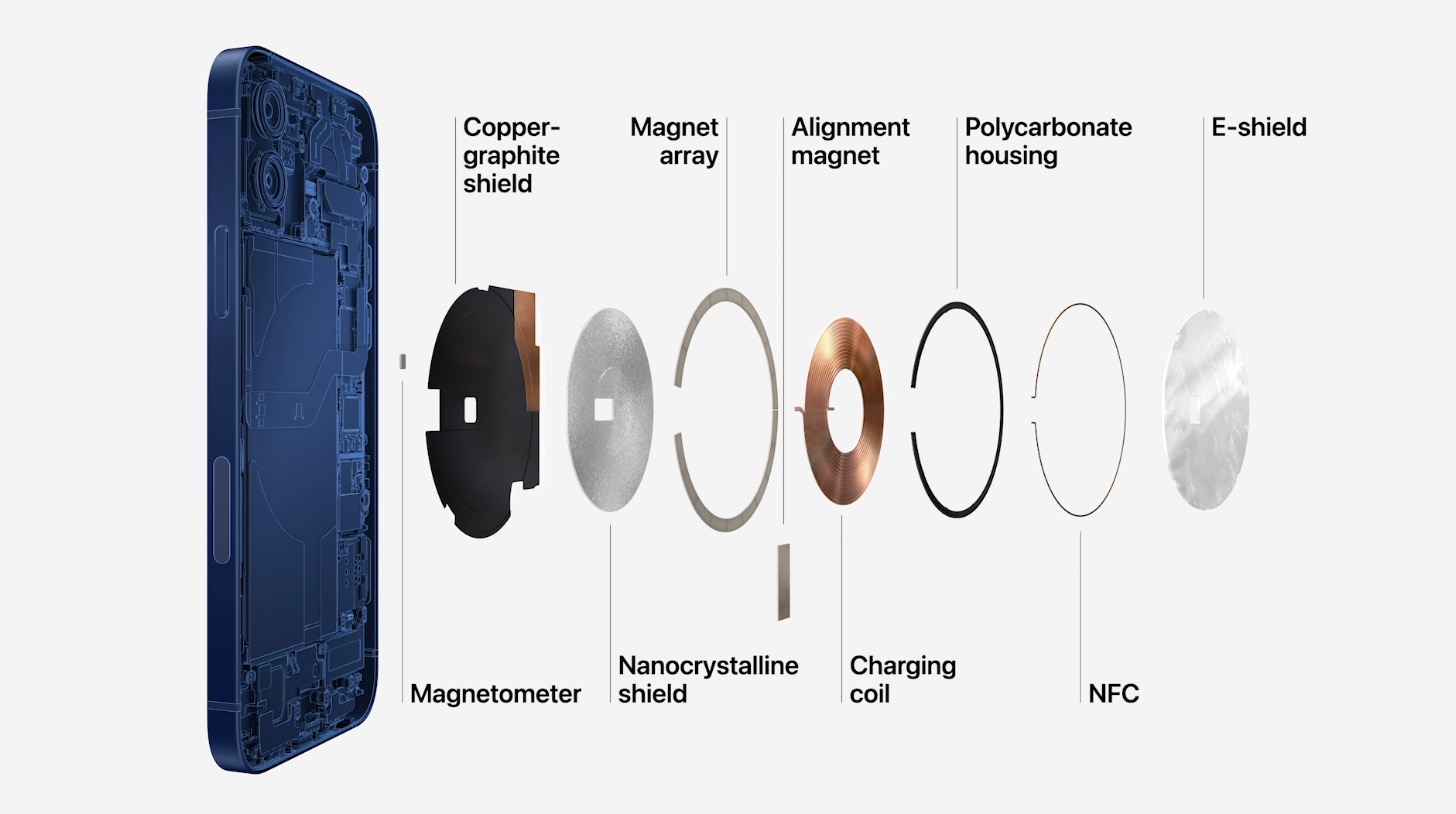

Speaking of charging, the Lightning port is still very much on-board, in-spite of dropping it on some iPad designs. Mentioning dropping things, Apple is getting rid of a bunch of the inbox devices, consisting of Earpods and the adapter, seemingly for environmental functions.

The handset sports the already-announced A14 bionic chip. Apple’s silicon sports six-cores on its CPU and 4 on its GPU. The latter will go a methods towards extending its position in mobile gaming. The company used that opportunity to announce that it will be bringing Riot Games’ League of Legends: Wild Rift to the handset. As expected, the base model 12 sports a dual-camera back– with 12-megapixel large and ultra-wide lenses. Night Mode has actually been enhanced throughout the devices and contributed to the front electronic camera.

The brand-new iPhone starts at $799– $100 more than the also-announced iPhone 12 mini. The design will likewise be signed up with by the higher-end Pro and Pro Max, priced as much as $1,099. The 12 and 12 Pro are readily available preorder on Oct 16 and starts shipping the 23rd. The Pro Max and mini variations ship on November 13.

It took a bit longer than usual (thank COVID-19 for some overwhelming production delays), but the iPhone 12 is here. And as expected, it comes bearing 5G. The most recent variation of Apple’s mobile phone also shows up in a range of different sizes, as the company continues to change to altering consumer buying patterns around mobile phones.

As anticipated, the line gets a complete redesign, obtaining hints from the iPad Pro, consisting of a flat edge more in line with older devices than the more recent curved designs. The device is likewise 11% thinner and lighter than its predecessor. The redesign also makes it possible for the business to load more antennas into the edge of the gadget.

The inclusion of next-gen wireless is, obviously, the flagship feature here. Apple is far from the first business to use 5G on a handset, however offered a little bit of a traffic jam in adoption provided the exceptionally odd year we’ve been experiencing. According to current numbers from Canalys, only 13% of handsets shipping in the very first half of the year were 5G capable. That implies there’s a long way to go, and Apple lastly embracing the tech will certainly move the needle.

There’s a Corning glass display. Apple says it worked directly with the Gorilla Glass maker to establish ceramic guard, which it states is around six-times more trustworthy in drop tests. The smartphone sports an OLED display (which appears to be constant throughout the brand-new devices, too), with double the variety of pixels as the iPhone 11.

CEO Tim Cook kicked off the statement by inviting Verizon(TC’s moms and dad co.)on stage to offer the provider’s UWB handle the tech and announce that it’s gone “nationwide.” 5G will be available on all of the new designs announced today. The specifics of the 5G will differ based on area– here in the States, for example, mmwave will also be readily available.

Apple is far from the very first business to use 5G on a handset, however provided a bit of a traffic jam in adoption provided the incredibly odd year we’ve been experiencing. As expected, the line gets a complete redesign, obtaining cues from the iPad Pro, including a flat edge more in line with older gadgets than the more recent curved designs. There’s a Corning glass display. Speaking of charging, the Lightning port is still very much on-board, in-spite of dropping it on some iPad designs. The model will likewise be signed up with by the higher-end Pro and Pro Max, priced up to $1,099.