VividQ Mikio Kawahara, chief financial investment officer of UTokyo IPC, stated,”The future of screen is holography. The need for enhanced 3D images in real-world settings is growing across the entire screen market. VividQ’s products will make the future aspirations of lots of consumer electronic devices organizations a reality.”

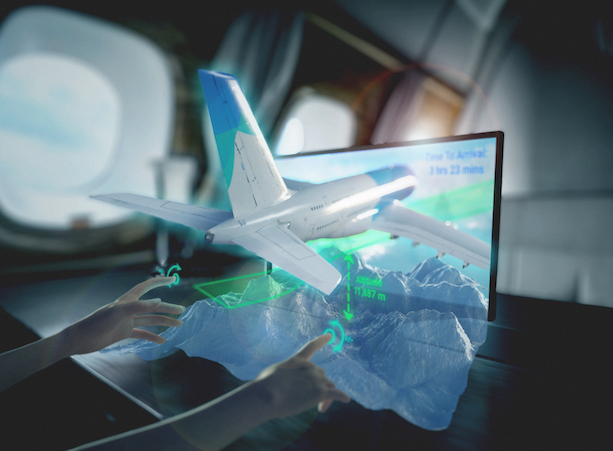

Speaking on a call with me, Milne included: “We have actually put the technology on video gaming laptops that can actually take use holographic screens on a standard LCD screen. So you understand the image is in fact extending out of the screen. We don’t use any optical trickery.”

VividQ, a UK-based deeptech startup with innovation for rendering holograms on legacy screens, has raised $15 million to establish its innovation for next-generation digital display screens and devices. And it’s already lining up manufacturing partners in the United States, China and Japan to do it.

, a UK-based deeptech start-up with technology for rendering holograms on legacy screens, has raised $15 million to establish its technology for next-generation digital displays and devices. “At VividQ, we are on an objective to bring holographic screens to the world for the very first time. Mikio Kawahara, chief investment officer of UTokyo IPC, said,”The future of display is holography. The need for enhanced 3D images in real-world settings is growing across the entire display screen market. Speaking on a call with me, Milne included: “We have actually put the innovation on gaming laptop computers that can in fact take make usage of holographic displays on a basic LCD screen.

The start-up is intending its technology at Automotive HUD, head-mounted displays (HMDs), and wise glasses with a Computer-Generated Holography that predicts “actual 3D images with real depth of field, making screens more natural and immersive for users.” It likewise says it has found a way to turn regular LCD screens into holographic screens.

The funding will be used to scale VividQ’s HoloLCD innovation, which, declares the business, turns consumer-grade screens into holographic display screens.

Established in 2017, VividQ has currently worked with ARM, and other partners, including Compound Photonics, Himax Technologies, and iView Displays.

The funding round, a Seed extension round, was led by UTokyo IPC, the venture financial investment arm for the University of Tokyo. It was joined by Foresight Williams Technology (a joint partnership in between Foresight Group and Williams Advanced Engineering), Japanese Miyako Capital, APEX Ventures in Austria, and the R42 Group VC out of Stanford. Previous investors University of Tokyo Edge Capital, Sure Valley Ventures, and Essex Innovation also took part.

Hermann Hauser, APEX Ventures’ consultant, and co-founder of Arm included: “Computer-Generated Holography recreates immersive projections that possess the exact same 3D information as the world around us. VividQ has the prospective to change how human beings connect with digital details.”

“When we state holograms, what we mean is a hologram is essentially an instruction set that tells light how to act. We calculate that impact algorithmically and then present that to the eye, so it’s equivalent from a genuine things. It’s entirely natural also. Your brain and your visual system are unable to identify it from something real since you’re literally providing your eyes the very same info that reality does, so there’s no trickery in the regular sense,” he said.

“Scenes we know from movies, from Iron Man to Star Trek, are ending up being better to truth than ever,” Darran Milne, co-founder and CEO of VividQ, stated. “At VividQ, we are on an objective to bring holographic display screens to the world for the very first time. Our services assist bring ingenious display items to the automobile industry, improve AR experiences, and quickly will change how we engage with personal devices, such as mobiles and laptop computers.”

If this works, it could definitely be a transformation, and I can see it being wed effectively with technology like UltraLeap.

BMW i Ventures’2nd goal is to provide tactical value back to the”mothership,” or BMW Group in Munich. By mainly investing in early phase companies, the firm has an early market signal that it can convey back to BMW. Behrendt says for a business like Solid Power, where the innovation is another 4 or 5 years out, there’s a strong collaboration in between BMW’s company system and the business to help them grow.

The company doesn’t run as a conventional business endeavor capital fund, but rather acts individually from BMW while being fully backed by the German automaker.”Sustainable supply chain is one of the things we’re truly interested in right now,” Marcus Behrendt, handling partner at BMW i Ventures, told TechCrunch. BMW i Ventures’second objective is to provide strategic worth back to the”mothership,” or BMW Group in Munich. By primarily investing in early stage business, the firm has an early market signal that it can convey back to BMW. Behrendt states for a business like Solid Power, where the innovation is another four or five years out, there’s a strong collaboration between BMW’s business system and the company to assist them grow.

Original text too long. Text can have up to 4,000 words.

Canoo’s investor day featured a range of executives, engineers and designers, all of whom focused on particular aspects of the business’s vision. The company has revealed a number of lorries, consisting of an electrical microbus, a pickup and one developed for business-to-business applications. The business rebranded as Canoo in spring 2019 and debuted its very first lorry numerous months later.

The facility, which the business describes as a “mega microfactory” will include a paint shop, body store and general assembly plant and is anticipated to open in 2023. Canoo’s financier day featured a range of designers, executives and engineers, all of whom focused on particular aspects of the business’s vision. The business has revealed a number of vehicles, consisting of an electrical microbus, a pickup and one created for business-to-business applications. The business rebranded as Canoo in spring 2019 and debuted its first vehicle several months later. And in May, the business disclosed that it is being examined by the U.S. Securities and Exchange Commission.

For commercial vehicles, Ford is working on a battery cell made with lithium ion phosphate chemistry, which it’s calling the Ion Boost Pro, which it states is less expensive and much better for duty cycles that require less range.

The Ford+ plan exposes the brand-new course car manufacturers will have to take if they desire to keep up with an EV future. This financial investment “highlights our belief that production-feasible solid state batteries are within reach in this decade,” said Hau Thai-Tang, Ford’s primary product platform and operations officer, throughout the investor day.

Ford is increasing its investment in its electric lorry future to $30 billion by 2025, up from a previous spend of $22 billion by 2023. The business revealed the fresh cashflow into its EV and battery development strategy, called Ford+, during an investor day on Tuesday.

The Ion Boost +’s unique cell pouch format is not only ideal for powering Ford’s bigger vehicles, but it could likewise assist the company decrease battery expenses 40% by mid-decade, the business says.

The Ford+ plan reveals the new course automakers will need to take if they wish to stay up to date with an EV future. Historically, China, Japan and Korea have owned much of the world’s battery manufacturing, but as major OEMs begin building electric cars, the demand is far outstripping supply, forcing cars and truck producers to invest their own resources into advancement. General Motors is building a battery factory with LG in Ohio, and BMW joined Ford to buy solid state battery startup Solid Power.

At Ford’s Ion Park facility, a battery R&D center Ford is integrating in Michigan, the automaker has brought together a group of 150 specialists to research study and create a strategy for the next generation of lithium ion chemistries and Ford’s new energy-dense battery technology, the Ion Boost +.

“Our supreme objective is to provide a holistic environment consisting of services that must permit us to attain higher profitability gradually with BEVs than we do today with ICE lorries,” said Thai-Tang.

This financial investment “underscores our belief that production-feasible solid state batteries are within reach in this years,” said Hau Thai-Tang, Ford’s primary item platform and operations officer, during the investor day. “Solid Power’s sulphide-based solid electrolyte and silicon-based anode chemistry provides remarkable battery improvements in efficiency, including increased range, lower expense, more lorry interior area and better worth and higher security for our consumers.”

The company stated it expects 40% of its global car volume to be completely electrical by 2030. Ford offered 6,614 Mustang Mach-Es in the U.S. in Q1, and considering that it unveiled its F-150 Lightning last week, the company states it has actually currently collected 70,000 client appointments.

The solid state battery production procedure doesn’t vary excessive from the existing lithium ion battery procedure, so Ford will have the ability to recycle about 70% of its manufacturing lines and capital investment, according to Thai-Tang.

“The cell chemistry, coupled with Ford’s exclusive battery control algorithm including high accuracy sensing innovation, delivers higher effectiveness and variety for customers,” said Thai-Tang.

At Ford’s Ion Park center, a battery R&D center Ford is building in Michigan, the automaker has actually united a team of 150 experts to research and develop a tactical plan for the next generation of lithium ion chemistries and Ford’s brand-new energy-dense battery innovation, the Ion Boost +.

This financial investment “underscores our belief that production-feasible solid state batteries are within reach in this decade,” said Hau Thai-Tang, Ford’s primary item platform and operations officer, during the investor day. “Solid Power’s sulphide-based solid electrolyte and silicon-based anode chemistry provides outstanding battery enhancements in efficiency, including increased variety, lower cost, more automobile interior area and better worth and higher safety for our clients.”

“Our ultimate objective is to provide a holistic community consisting of services that ought to enable us to achieve higher profitability with time with BEVs than we do today with ICE lorries,” said Thai-Tang.

“The cell chemistry, combined with Ford’s proprietary battery control algorithm featuring high precision picking up innovation, provides higher efficiency and variety for clients,” stated Thai-Tang.

For business lorries, Ford is working on a battery cell made with lithium ion phosphate chemistry, which it’s calling the Ion Boost Pro, which it says is cheaper and much better for task cycles that require less range.

The business stated it anticipates 40% of its international car volume to be totally electrical by 2030. Ford sold 6,614 Mustang Mach-Es in the U.S. in Q1, and given that it revealed its F-150 Lightning last week, the business states it has already generated 70,000 client appointments.

The Ford+ plan exposes the new path car manufacturers will have to take if they desire to keep up with an EV future. This investment “underscores our belief that production-feasible strong state batteries are within reach in this years,” said Hau Thai-Tang, Ford’s primary item platform and operations officer, throughout the investor day.

Ford is increasing its financial investment in its electric car future to $30 billion by 2025, up from a previous invest of $22 billion by 2023. The business announced the fresh cashflow into its EV and battery development strategy, dubbed Ford+, throughout an investor day on Tuesday.

The Ion Boost +’s unique cell pouch format is not only ideal for powering Ford’s larger vehicles, however it might also assist the business decrease battery expenses 40% by mid-decade, the business states.

If they want to keep up with an EV future, the Ford+ strategy reveals the new course automakers will have to take. Historically, China, Japan and Korea have actually owned much of the world’s battery manufacturing, but as significant OEMs begin building electric vehicles, the need is far overtaking supply, forcing car producers to invest their own resources into advancement. General Motors is building a battery factory with LG in Ohio, and BMW signed up with Ford to buy strong state battery startup Solid Power.

The strong state battery manufacturing procedure does not vary too much from the existing lithium ion battery procedure, so Ford will be able to reuse about 70% of its production lines and capital financial investment, according to Thai-Tang.

The Ford+ strategy reveals the new course automakers will have to take if they want to keep up with an EV future. This investment “highlights our belief that production-feasible solid state batteries are within reach in this decade,” stated Hau Thai-Tang, Ford’s chief product platform and operations officer, throughout the investor day.

The Ford+ strategy exposes the brand-new course car manufacturers will have to take if they desire to keep up with an EV future. This financial investment “underscores our belief that production-feasible strong state batteries are within reach in this years,” said Hau Thai-Tang, Ford’s chief product platform and operations officer, throughout the investor day.

The Ford+ plan reveals the brand-new path car manufacturers will have to take if they desire to keep up with an EV future. This financial investment “underscores our belief that production-feasible solid state batteries are within reach in this decade,” said Hau Thai-Tang, Ford’s chief item platform and operations officer, during the financier day.

The Ford+ plan reveals the brand-new course automakers will have to take if they want to keep up with an EV future. This investment “highlights our belief that production-feasible solid state batteries are within reach in this decade,” said Hau Thai-Tang, Ford’s primary item platform and operations officer, throughout the investor day.

The Ford+ plan reveals the brand-new path automakers will have to take if they want to keep up with an EV future. This financial investment “highlights our belief that production-feasible strong state batteries are within reach in this years,” stated Hau Thai-Tang, Ford’s primary item platform and operations officer, during the investor day.

The Ford+ plan reveals the brand-new path automakers will have to take if they want to keep up with an EV future. This financial investment “highlights our belief that production-feasible solid state batteries are within reach in this decade,” stated Hau Thai-Tang, Ford’s primary item platform and operations officer, throughout the financier day.

The Ford+ plan exposes the brand-new course car manufacturers will have to take if they want to keep up with an EV future. This financial investment “underscores our belief that production-feasible strong state batteries are within reach in this years,” said Hau Thai-Tang, Ford’s chief product platform and operations officer, during the financier day.

Ford is increasing its investment in its electrical vehicle future to $30 billion by 2025, up from a previous invest of $22 billion by 2023. The business revealed the fresh cashflow into its EV and battery development technique, dubbed Ford+, during a financier day on Tuesday.

“The cell chemistry, coupled with Ford’s exclusive battery control algorithm including high precision sensing technology, delivers greater performance and range for customers,” said Thai-Tang.

The Ford+ plan reveals the new course car manufacturers will have to take if they wish to keep up with an EV future. Historically, China, Japan and Korea have actually owned much of the world’s battery manufacturing, however as major OEMs begin developing electrical automobiles, the demand is far outstripping supply, forcing automobile makers to invest their own resources into advancement. General Motors is developing a battery factory with LG in Ohio, and BMW signed up with Ford to purchase strong state battery start-up Solid Power.

At Ford’s Ion Park facility, a battery R&D center Ford is integrating in Michigan, the car manufacturer has brought together a group of 150 professionals to research and develop a tactical plan for the next generation of lithium ion chemistries and Ford’s brand-new energy-dense battery technology, the Ion Boost +.

This financial investment “underscores our belief that production-feasible solid state batteries are within reach in this years,” said Hau Thai-Tang, Ford’s chief item platform and operations officer, throughout the investor day. “Solid Power’s sulphide-based strong electrolyte and silicon-based anode chemistry delivers impressive battery improvements in performance, including increased range, lower expense, more lorry interior space and better worth and greater safety for our consumers.”

The strong state battery manufacturing procedure does not differ excessive from the existing lithium ion battery procedure, so Ford will be able to reuse about 70% of its production lines and capital investment, according to Thai-Tang.

The business stated it expects 40% of its international vehicle volume to be fully electric by 2030. Ford offered 6,614 Mustang Mach-Es in the U.S. in Q1, and since it unveiled its F-150 Lightning recently, the company states it has actually currently collected 70,000 client bookings.

“Our supreme goal is to deliver a holistic environment including services that need to enable us to accomplish higher success with time with BEVs than we do today with ICE lorries,” stated Thai-Tang.

For business cars, Ford is dealing with a battery cell made with lithium ion phosphate chemistry, which it’s calling the Ion Boost Pro, which it says is more affordable and better for responsibility cycles that require less variety.

The Ion Boost +’s special cell pouch format is not only perfect for powering Ford’s larger lorries, however it might likewise help the company minimize battery expenses 40% by mid-decade, the company states.