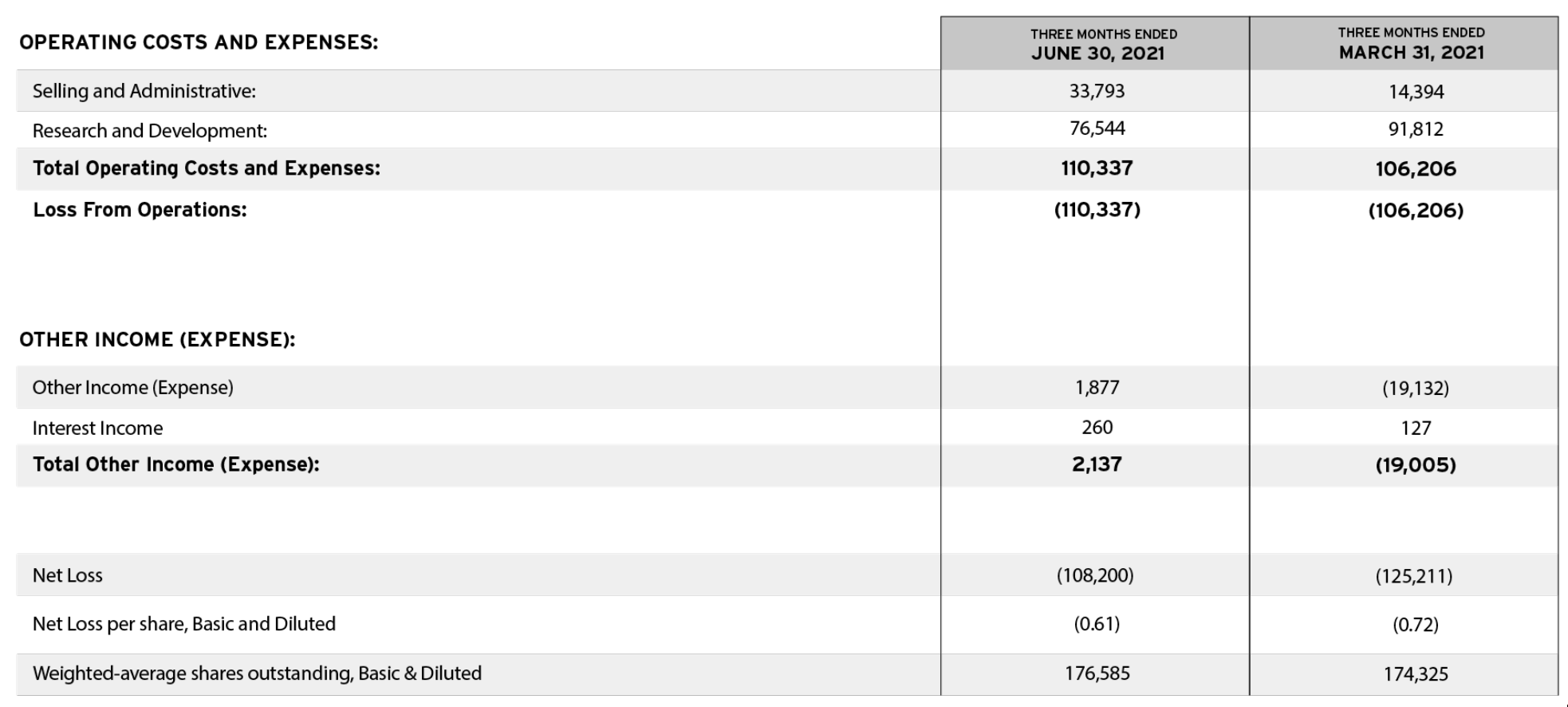

Lordstown cut research study and development costs by 17% from the previous quarter to $76.5 million.

Lordstown was riding high in late 2020, when it announced its SPAC merger with a value of $1.6 billion. Its shares skyrocketed to $31.80 apiece at their 52-week highs. They’ve given that dropped to $5.94.

The Lordstown executive team has actually not had a smooth summertime. The company revealed in June the resignations of both CEO Steve Burns and CFO Julio Rodriguez, who were changed in an interim capacity by Strand and Roof respectively. Lordstown was founded as an offshoot of Burns’ company Workhorse Group– the very same company that stated it had actually offered 11.9 million shares, or nearly three-quarters of its stake, since the start of July. The company is actively searching for a CEO and CFO, Strand said.

“We still prepare to be very first to market, particularly in the commercial fleet space,” Strand stated.

The beleaguered EV start-up Lordstown Motors is on track to start production of its flagship electrical truck Endurance, but just select customers will start to receive lorries early next year, executives stated during a 2nd quarter revenues call.

Image Credits: Lordstown Motors( opens in a new window)The decline in R&D costs was due to declines in purchases of vehicle parts, as a lot of those were acquired in previous quarters, Lordstown interim CFO Becky Long said throughout a financier call. Legal costs were $9 million higher than last quarter, due to costs related to a special committee and a Securities and Exchange Commission examination over whether Lordstown exaggerated pre-sales. (The enjoyable doesn’t stop there– the company is likewise under examination by the U.S. Attorney’s Office for the Southern District of New York.)

Executives struck a cautious tone in the second-quarter profits call as they tried to lighten shareholder issues and address the near-term truths of bringing its first car to market with no income to offset its costs. Lordstown’s method, at least this quarter, was to try and lower operating expenses from the previous quarter, helping it offset its boost in capital investment.

Lordstown reported a net loss of $108 million, a 13.7% improvement from the very first quarter loss of $125 million. Legal expenditures were $9 million greater than last quarter, due to expenses related to an unique committee and a Securities and Exchange Commission examination over whether Lordstown exaggerated pre-sales. One thing that differentiates the business from some of its competitors is its manufacturing plant– a 6.2 million square foot former General Motors plant in Lordstown, Ohio. Hair said “major conversations” were underway with prospective partners to use Lordstown’s center to manufacture their items, suggesting the business is excited to discover additional sources of revenue to offset its mounting costs. Lordstown was established as a spin-off of Burns’ company Workhorse Group– the same business that stated it had sold 11.9 million shares, or almost three-quarters of its stake, considering that the start of July.

Something that differentiates the business from some of its competitors is its factory– a 6.2 million square foot previous General Motors plant in Lordstown, Ohio. It’s now looking like the business is exploring different ways to make a profit off this possession. Hair stated “major conversations” were underway with potential partners to use Lordstown’s center to manufacture their items, suggesting the business aspires to find additional sources of income to offset its installing expenses. “This is a vital tactical pivot for us, a choice that our company believe will cause considerable brand-new income opportunities for Lordstown,” she stated.

It increased its capital expenditures to $121 million from $53 million in the first quarter. Lordstown likewise increased its capital investment guidance for the year, from $250 million to $275 million to a $375 million to $400 million variety, a spike associated to its requirement to prepay for equipment.

“We are checking out several collaboration constructs,” she included. “That consists of contract manufacturing, that includes licensing, in addition to producing our own automobiles,” she included.

Lordstown reported a net loss of $108 million, a 13.7% improvement from the very first quarter loss of $125 million. Its bottom lines are more than tenfold greater than the -$7.9 million it reported in the very same duration last year.

Lordstown was tossed a life vest previously this summer, when investment company Yorkville Advisors consented to acquire up to $400 countless Lordstown’s shares. The business is “now checking out a range of other financing alternatives, consisting of non-dilutive private strategic investments and financial obligation,” interim CEO Angela Strand stated throughout a financier call. The company is likewise still pursuing a loan with the U.S. Department of Energy, Long stated during the call.

The company stated it was still on track to start production of the Endurance at the end of September, only “choose early clients” will begin to receive automobiles in the first quarter of 2022, followed by business shipments in the 2nd quarter. Strand stated this implementation plan is to permit fleet consumers time to construct out charging infrastructure and to handle supply chain difficulties.

“We are thrilled to bring ExOne into the DM family to develop the leading additive production portfolio for mass production,” Desktop Metal CEO Ric Fulop stated in a release. Desktop Metal has actually been actively pursuing acquisitions to grow out its 3D printing portfolio because it revealed plans to go public via SPAC last August.”We are excited to join forces with Desktop Metal to provide a more sustainable future through our shared vision of additive manufacturing at high production volumes,” Hartner said of today’s statement.

Today’s deal, which is valued at $575 million, finds Desktop Metal acquiring all of ExOne’s common stock.

As part of its profits call this week, Desktop Metal announced strategies to acquire ExOne. The Pennsylvania-based firm develops a range of different commercial 3D printers for markets like aerospace, automotive, medical and defense. More just recently, we blogged about the company’s portable 3D printing factories, which are efficiently mobile additive production stations built within shipping containers.

“Over the last two years, we’ve actually concentrated on supplying our innovation into government-type applications: DoD, NASA, DoE,” ExOne’s CEO John Hartner informed TechCrunch when that news broke. “Sometimes people discuss interfering with the supply chain and getting decentralized manufacturing. This is decentralized and forward-deployed, if you will. Be it an emergency, humanitarian mission or frontlines for a war fighter.”

Desktop Metal has been actively pursuing acquisitions to grow out its 3D printing portfolio since it announced plans to go public via SPAC last August. In January, it obtained EnvisionTEC for $300 million.

“We are delighted to bring ExOne into the DM household to develop the leading additive production portfolio for mass production,” Desktop Metal CEO Ric Fulop said in a release. “We think this acquisition will provide clients with more choice as we leverage our complementary innovations and go-to-market efforts to drive continued development. This deal is a huge step in providing on our vision of speeding up the adoption of additive manufacturing 2.0.”

We blogged about ExOne back in February, when the company was approved $1.6 million from the DoD, in hopes of taking the systems out into the field. Each system includes a 3D scanning station with computer system and a range of various ruggedized industrial machines, including a metal and ceramic printer, treating oven, fiber-reinforced plastic printer and a compression modeling station.

“We are thrilled to sign up with forces with Desktop Metal to deliver a more sustainable future through our shared vision of additive manufacturing at high production volumes,” Hartner stated these days’s statement. “We believe our complementary platforms will much better serve customers, speed up adoption of green innovations, and drive increased investor worth. Most significantly, our technologies will help drive crucial developments at significant production volumes that can improve the world.”

“We develop effective, dependable bikes, bikes that are easy and confidence-inspiring to utilize,” Redwood Stephens, chief item officer of Rad Power Bikes, informed TechCrunch. Stephens says the business is so concerned with a smooth consumer experience, right down to how you take the bike out of its box, that Rad Power’s product packaging and designing engineers work right together with the bike designers so that the direct-to-consumer experience is thought about throughout the design process. The business has 4 retail shops (in Seattle, San Diego, Vancouver and Europe, where it likewise offers its bikes), and it has also set up a partner network with regional bike shops that are accredited to work on its bikes and even assemble them from the box at customers’ homes.

“We develop effective, trusted bikes, bikes that are confidence-inspiring and simple to utilize,” Redwood Stephens, primary item officer of Rad Power Bikes, told TechCrunch. Rad Power’s main customers aren’t urban bicycle riders, and at 73 pounds a bike, it’s not hard to see why– Try carrying that up your third floor walkup. Stephens states the company is so concerned with a smooth consumer experience, right down to how you take the bike out of its box, that Rad Power’s packaging and creating engineers work right together with the bike designers so that the direct-to-consumer experience is thought about throughout the design process. There’s also been some updates to the battery, which was designed internal and lives directly in the frame of the bike. The business has 4 retail shops (in Seattle, San Diego, Vancouver and Europe, where it likewise offers its bikes), and it has likewise set up a partner network with local bike stores that are licensed to work on its bikes and even assemble them from the box at customers’ homes.

Infra.Market, which takes on Lightspeed-backed Zetwerk, helps small services such as makers of paints and cements enhance the quality of their production and satisfy various compliances.

The start-up, which stated it expects to go beyond $1 billion in sales by the end of this calendar year, plans to deploy the fresh fund to broaden to brand-new markets and likewise expand into new classifications. It’s also aiming to obtain more youthful firms, the startup stated.

These improvements, explained co-founder Souvik Sengupta, assist small makers land larger customers that have higher expectations from business with which they engage. He said the startup has assisted small makers reach consumers outside of India. A few of its clients remain in Bangladesh, Malaysia, Singapore and Dubai.

Infra.Market, an Indian startup that is assisting building and property business in the world’s second-most inhabited country procure products and deal with logistics for their projects, stated on Tuesday it has protected its 3rd funding round in the previous 9 months.

The start-up adds its load cells to the production facilities of these little businesses to make sure there is no lapse in quality, and also assists them deal with other companies that can supply them with much better basic material and offer assistance on prices. It also works closely with services to ensure that their shipments are made on time.

“We continue to build on our vision of developing India’s biggest multiproduct construction materials brand name and change the building and construction materials supply chain, not only in India, however likewise globally,” he said.

“We are pleased to double-down on our investment in Infra.Market. The team has shown exceptional growth and continues to disrupt the building and construction materials market. Over the previous year, Infra.Market has become the go-to partner, specifically throughout the pandemic when the standard supply chains were disrupted,” said Scott Shleifer, partner, Tiger Global Management, in a declaration.

“We are also starting new organization verticals within the building ecosystem beyond materials to allow us to supply end to end solutions to our customers throughout the life cycle of a building job. We are seeing huge growth in purchaser wallet share as we are quickly expanding our item portfolio and market presence and the launch of brand-new verticals will help us satisfy our vision of producing a technology backed end to end building and construction solutions business.”

Tiger Global, which led the startup’s Series C round in February this year, has led the $125 million Series D funding round in the five-year-old startup. The brand-new round valued Mumbai-headquartered Infra.Market at $2.5 billion (post-money), up from $1 billion in February and $200 million in December last year. The start-up, which counts Nexus, Foundamental and Accel Partners among its investors, has raised about $275 million to date.

The startup includes its load cells to the production centers of these small services to ensure there is no lapse in quality, and likewise helps them work with other organizations that can supply them with better raw material and provide guidance on prices.”We are likewise embarking on new organization verticals within the building environment beyond materials to enable us to provide end to end services to our clients throughout the life cycle of a building and construction job. The startup, which said it anticipates to surpass $1 billion in sales by the end of this calendar year, prepares to deploy the fresh fund to expand to new markets and also expand into brand-new categories.

Along with China, the business are eyeing South Korea as a crucial market for their joint endeavor., which reported that Renault and Geely are thinking about making totally electric automobiles. Having a collaboration in China appears essential for Renault, which has actually struggled to offer automobiles under its own name in the country.

The business plan to take benefit of Geely’s supply chain and manufacturing capabilities. Along with China, the business are considering South Korea as a crucial market for their joint endeavor., which reported that Renault and Geely are thinking about making totally electric automobiles. Having a collaboration in China appears essential for Renault, which has actually struggled to offer vehicles under its own name in the country.

When I move my finger around, my horrific human greases make electrons leap, and that makes me feel like I’m touching the apps. Underneath those abstractions is, of course, code, code, code: C, C++, JavaScript, PHP, Python. As I read more about the physics of chips, I started to have a kind of acceptance of assembly language. Billions of years earlier, I discovered, an evil witch, or maybe God Themself, cursed the class of materials known as silicates, which are plentiful on this planet, and made them neither insulators nor conductors however rather an eldritch scary known as semiconductors. And as soon as I began to accept that mess and internalize– to accept that the computer is a strange hack of truth– it all ended up being kind of enjoyable.

As I read more about the physics of chips, I began to have a kind of approval of assembly language. Billions of years earlier, I found out, a wicked witch, or perhaps God Themself, cursed the class of products understood as silicates, which are plentiful on this planet, and made them neither insulators nor conductors but rather an eldritch scary understood as semiconductors. And as soon as I started to accept that mess and internalize– to accept that the computer system is a strange hack of truth– it all ended up being kind of fun.

Yeah, seems odd that Tesla wasn’t invited

— Elon Musk (@elonmusk) August 5, 2021

A few of the investments they note include customer incentives, a national EV charging network “of sufficient density,” moneying for R&D and manufacturing and supply chain incentives.

Biden’s target, which will come in the form of an executive order on Thursday, will be entirely voluntary and nonbinding. The target includes vehicles powered by batteries, hydrogen fuel cells or plug-in hybrids.

Biden will also be requiring brand-new fuel economy standards for traveler and medium- and sturdy automobiles through design year 2026, which were rolled back under President Trump’s period, according to a White House factsheet released Thursday. The new standards, which will be crafted under the jurisdiction of the Department of Transportation and the Environmental Protection Agency, need to come as not a surprise to automakers: They were consisted of in Biden’s so-called “Day One Agenda” and mark a cornerstone of his strategy to combat climate modification.

Executives from the three OEMs, along with representatives from the United Automobile Workers union, are expected to participate in an occasion on the brand-new target at the White House Thursday. Tesla, it appears, was not invited, according to a tweet from CEO Elon Musk.

General Motors, Ford and Stellantis (formerly Fiat Chrysler) provided a joint statement Thursday that they had “shared aspiration [s] to attain a 40% to 50% share of electric in brand-new vehicle sales by the end of the decade, with the caution that such a target “can be accomplished just with the prompt deployment of the full suite of electrification policies devoted to by the Administration in the Build Back Better Plan.”

President Joe Biden is anticipated to set an enthusiastic new target for half of all new vehicle sales in the U.S. to be low- or zero-emission by 2030, a strategy that has actually gotten tentative support from the Big Three car manufacturers pending what they state will need significant government assistance.

The new requirements will likely obtain from those gone by California in 2015, which were completed in performance with a coalition of five automakers: BMW AG, Ford, Honda Motor Co., Volkswagen AG, and Volvo AB. Those car manufacturers, in a different declaration Thursday, stated they supported the White House’s strategy to lower emissions. However, like the Big Three, they stated that “strong action” from the federal government will be needed to achieve emission reductions targets.

The road to 2030

Thanks to the relatively long item advancement preparation, a lot of the significant automakers have already announced multibillion-dollar investments in EVs and AVs a minimum of through the middle of the decade. That includes a $35 billion investment through 2025 from GM and $30 billion through the very same year from Ford— not to mention similar statements from Stellantis and lots of billions allocated for battery R&D from Volkswagen, and even Volvo Cars’shift to all-electric by 2030. These massive numbers follow the car manufacturers’own sales targets, which are for the most part in line with Biden’s goal. Fuel economy guidelines, however, have actually historically amassed a little more combined reactions from car manufacturers. GM, Fiat Chrysler(now Stellantis )and Toyota had formerly supported a Trump-era

While Biden’s nonbinding order is more of a symbolic one, the targets are most likely possible, Jessica Caldwell, Edmunds’ executive director of insights stated in a statement. She included that vehicle market leaders “have seen the composing on the wall for some time now” regarding electrification, no matter who has actually remained in the White House.

claim that sought to strip California’s authority to set its own emissions requirements– however each company ultimately made an about-face,

Biden’s target, which will come in the kind of an executive order on Thursday, will be nonbinding and completely voluntary. Executives from the three OEMs, as well as agents from the United Automobile Workers union, are expected to go to an event on the brand-new target at the White House Thursday. While Biden’s nonbinding order is more of a symbolic one, the targets are most likely achievable, Jessica Caldwell, Edmunds’ executive director of insights said in a declaration. These huge numbers follow the car manufacturers’own sales targets, which are for the a lot of part in line with Biden’s objective. In a really real sense, Biden’s announcement is as much about geopolitics as it is about climate change.

President Ray Curry stated in a declaration that the group is “not concentrated on hard due dates or portions, however on protecting the earnings and benefits that have been the heart and soul of the American middle class. ”

Lee Rawn, senior director of transport at Ceres, said in a declaration that future standards ought to target a 60 %decrease in emissions and a”clear trajectory”to 100%automobile sales by 2035. Although the UAW will be joining Biden at the White House on Thursday,

leaving the roadway open for Biden to introduce his own requirements this year. In a very genuine sense, Biden’s announcement is as much about geopolitics as it has to do with environment modification. He, too, has actually seen the writing on the wall relating to EVs. His administration notes in the factsheet that “China is significantly cornering the international supply chain “for EVs and EV battery materials.” By setting clear targets for electrical lorry sale

trajectories, these countries are ending up being magnets for private financial investment into their production sectors– from parts and materials to last assembly.”While three times as many EVs were signed up in the U.S. in 2020 versus 2016, America still drags both Europe and China in terms of EV market share, according to the International Energy Agency. The news has actually gathered a multitude of mixed responses, with some ecological groups advising more decisive action on the part of the administration. Carol

Grayson saw a chance to establish an endeavor brand more hyperfocused on the types of deals she was doing at NEA, which centered around production and digitizing industrial verticals. That’s where Construct Capital was available in. It’s a $140 million fund helmed by Grayson and previous Uber exec Rachel Holt.

Grayson has actually more than proven that she has a keen eye for transformational innovation. Desktop Metal went public in 2020– she still rests on the board as chair of the settlement committee. Onshape, another NEA-era investment, was gotten by PTC in 2019 for a whopping $525 million. Framebridge was also gotten by Graham Holdings in 2020.

At Disrupt, Grayson will function as a Startup Battlefield judge. The Battlefield is among the world’s most prominent and exciting start-up competitors. Twenty+ early-stage startups get on our phase and present their wares to a panel of specialist VC judges, who then grill the founders on whatever about business, from the income model to the go-to-market strategy to the team to the innovation itself.

Interfere with 2021 decreases from September 21 to 23 and is virtual. Snag a ticket here beginning under $100 for a limited time!

At NEA, where she was a partner for eight years, she led financial investments in and sat on the boards of companies including Desktop Metal, Onshape, Framebridge, Tulip, Formlabs and Guideline. She left NEA to start her own fund, Construct Capital, that focuses specifically on early-stage startups, with a portfolio that includes Copia, ChargeLab, Tradeswell and Hadrian.

It must come as no surprise, then, that we’re definitely delighted to have Grayson join us at TechCrunch Disrupt 2021 in September.

The winner leaves with $100,000 in prize money and the glory of being a Battlefield winner. Families names in tech have gotten their start in the Battlefield, from Dropbox to Mint.

Grayson signs up with lots of other seasoned financiers on the Battlefield stage, consisting of Camille Samuels, Deena Shakir, Terri Burns, Shauntel Garvey and Alexa Von Tobel.

At NEA, where she was a partner for 8 years, she led investments in and sat on the boards of companies including Desktop Metal, Onshape, Framebridge, Tulip, Formlabs and Guideline. Grayson has actually more than proven that she has a keen eye for transformational technology. Grayson saw a chance to develop an endeavor brand name more hyperfocused on the types of offers she was doing at NEA, which focused around manufacturing and digitizing commercial verticals. The Battlefield is one of the world’s most exciting and prestigious start-up competitors.

Dayna Grayson has been in endeavor capital for more than a years and was among the very first VCs to construct a portfolio around the transformation of industrial sectors of our economy.

Rivian is hardly the only automaker coming to grips with the international chip scarcity. GM, Ford, Toyota and virtually every other car manufacturer has either slowed production or constructed its cars without specific functions supported by chips. GM is now building particular mid- and full-sized SUVs without a cordless phone charging feature due to the global scarcity of semiconductor chips.

Unlike the established players with plenty of incoming earnings, Rivian is a beginner that is attempting to be the first automaker to bring an electric pickup truck to market. Ford plans to bring the electrical F-150 Lightning pickup to market in spring 2022. Production of a GMC Hummer EV pickup is anticipated to begin later on this year.

Rivian is pressing back deliveries of its long-awaited R1T electrical pickup and R1S SUV numerous more months due to delays in production brought on by “cascading effects of the pandemic,” particularly the continuous global scarcity of semiconductor chips, according to a letter sent out to clients from CEO RJ Scaringe. The R1T shipments will start in September with the R1S to follow “shortly,” Scaringe wrote in the message.

Shipments of the R1T Launch Edition lorries, the restricted edition release of its very first series of “electric adventure automobiles,” were supposed to start in July after being delayed by a month.

Here’s a sector of the letter, which was seen by TechCrunch:

The founder and CEO likewise acknowledged that the business needed to enhance how it interacts specifics around deliveries.

GM, Ford, Toyota and practically every other automaker has either slowed production or constructed its lorries without specific features supported by chips. Earlier this summertime, we revealed that shipments would begin in July; however, the timing for the first deliveries of the R1T has moved to September, with the R1S shortly afterwards in the fall. Whatever from center building and construction, to devices installation, to lorry component supply (particularly semiconductors) has been affected by the pandemic. The Rivian factory in Normal, Illinois, has two different production lines producing automobiles, according to Scaringe. In 2019, Rivian announced it was establishing an electrical delivery van for Amazon using its skateboard platform.

There are numerous reasons why our production ramp is taking longer than expected. The cascading impacts of the pandemic have had a compounding effect greater than anybody expected. Everything from center building and construction, to equipment setup, to lorry part supply (especially semiconductors) has been affected by the pandemic. Beyond these unexpected difficulties, launching 3 new cars while establishing a multi-vehicle production plant is a complicated orchestra of coordinated and interlinked activities where small issues can translate into ramp delays.

Scaringe stated Rivian has actually “developed hundreds of lorries as part of our recognition procedure, with a number of those found out in the wild covered in special vinyl covers.” He also dealt with why those lorries have not been provided to consumers, keeping in mind that the business thinks “it is crucial to both our long-term success and your supreme fulfillment that the quality and robustness of our launch products really sets the tone for what to get out of us as a brand.”

In 2019, Rivian announced it was developing an electric delivery van for Amazon using its skateboard platform. Amazon bought 100,000 of these vans, with deliveries starting in 2021. Previously this year, Amazon began evaluating the electrical delivery van in Los Angeles and San Francisco.

Scaringe supplied a few more information about the company’s development, including it now employs more than 7,000 individuals. The Rivian factory in Normal, Illinois, has 2 different production lines producing automobiles, according to Scaringe. One is committed for the R1 cars and other line is for its industrial vans.

We know you can’t wait to support the wheel of your vehicle. Earlier this summer season, we revealed that deliveries would start in July; nevertheless, the timing for the first deliveries of the R1T has actually shifted to September, with the R1S quickly thereafter in the fall. I wished to make certain you heard this from me straight.

Aside from the center-mounted selfie cam and an in-display finger print scanner, Google isn’t sharing much else about the Pixel. Osterloh says the business will go into higher information in the fall, closer to the Pixel 6’s main launch. Osterloh says Google still prepares to bring some new functions to older Pixels, as it has actually done for the previous couple of years, however it’s still reliant on whether the hardware can handle it. Google’s investment in its own chips highlights the business’s dedication to consumer hardware, even though Google still just declares a single-digit portion share of the international smartphone market. “For this specific chip, we have a lot of control over it, and we do not believe the Pixel 6 line will be constrained.

Aside from the center-mounted selfie electronic camera and an in-display fingerprint scanner, Google isn’t sharing much else about the Pixel. Osterloh states Google still plans to bring some new features to older Pixels, as it has actually done for the past few years, however it’s still dependent on whether the hardware can handle it. Google’s investment in its own chips underscores the company’s dedication to consumer hardware, even though Google still only claims a single-digit percentage share of the worldwide smartphone market.