Unemployment Reality Check

To discover the answers, it is crucial to look much better on how this report is produced. The unemployment data actually consists of 2 different studies. The facility and the family study. Both surveys utilize totally different sources of data and have various sample sizes, with various margins of errors, assumptions and inputs.

The Household Survey

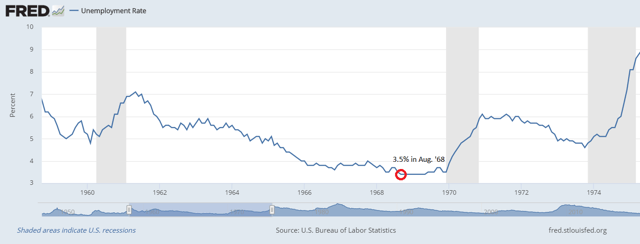

Unemployment rate during the 1960s In August 1968, the joblessness rate was up to 3.5%. 3 months later on the Dow began dropping from 985 to 683. The unemployment rate as an indicator Historically, it quickly ends up being clear that the unemployment rate is a lagging indication. It typically is at its most affordable often simply months prior to an economic downturn. By this time, the stock market has actually long remedied based upon other economic data and decreasing revenues. The chart listed below demonstrates the delayed nature of the joblessness rate(economic crises in gray).

. The Unemployment rate and the 1960s Now that the joblessness rate has actually struck 3.5%, we hear contrasts to the ’60s. That must be a caution.

Disclosure: I am/we are long PSQ. I composed this article myself, and it expresses my own opinions. I am not getting settlement for it (besides from Seeking Alpha). I have no company relationship with any company whose stock is discussed in this article.

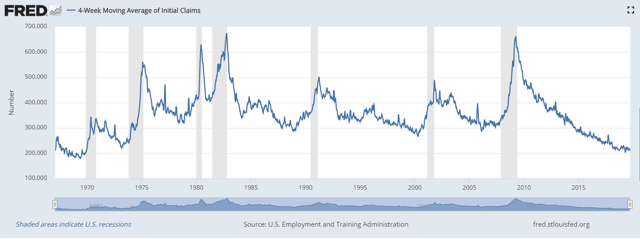

Unemployment rate Sometimes, joblessness information can offer some leading sign of an economic downturn. The initial claims of joblessness frequently trend up previously, however this

It is essential to note that the household survey includes a much larger set of employees, but a smaller sized sample size with a really large margin of error. Compared to the facility survey, it includes agricultural, self-employed, overdue employees, etc. The Establishment Survey Sequel of the work report, the facility study, paints a somewhat different image. Economists forecast a fairly rose future at a month-to-month increase of 145,000 overall non-farm payrolls. Looking at the year-over-year portion modification of the payroll data, one can easily see that the labor market turns on a cent. Below are the last few economic cycles. In each case, it took just a few months from strong work to economic downturn (economic crises in gray). All Employees, Total Nonfarm, Percent Change from Year Ago, Seasonally Adjusted Payroll data normally declines a bit ahead of an economic crisis compared to the joblessness rate, as can be seen from the charts above. Payroll data is thought about a coincident financial indication due to the fact that of that. If the payroll data continues to disappoint, an economic downturn is not far out

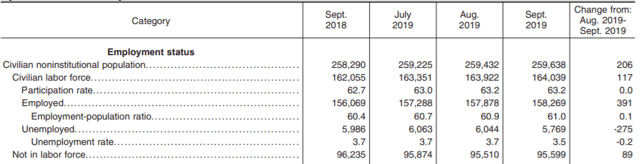

Let’s have a look at this month’s family study to comprehend relocations in the unemployment rate. Because our population is constantly growing, job growth has to offset this population growth to keep work consistent. Anything less and the joblessness rate increases and vice versa. The workforce is projected to grow 0.5% annually due to population growth. The Bureau of Labor Statistics works with the U.S. Census Bureau to estimate modifications in the U.S. population. The information is based upon the Current Population Survey. Changes to the population numbers are made accordingly. On top of that, all numbers are seasonally changed. In September, 117,000 new employees signed up with labor force, according to the family survey. That lots of new employees in September is a fairly little quantity. In August, 5 times as lots of employees were contributed to the manpower.

When unemployment data turns sour, the economy is already in deep trouble. As I’ve shown above, the onset of an economic downturn is often less than a year away once unemployment indicators begin to reverse. We can be assured that we are exceptionally close to an economic crisis because these reversals are usually sharp if we do begin to see considerable patterns. Already, the market has more than likely currently began its descent because there are lots of leading indicators that will have made that really clear before we get there. This past week the manufacturing and services PMIs have given us a taste.

Now numerous dynamics are at work. Most importantly, workers contributed to the labor force require tasks. The unemployment rate drops and vice versa if we have a month where the net addition of jobs surpass the increase in the labor force. This happened in September – which was not hard to accomplish, offered that the workforce grew by just 117,000 employees. In August, 571,000 employees joined the labor force with about the exact same variety of net job adds, holding the rate continuous. Now imagine next month we had the same variety of new workers, however this month’s low net increase in jobs of 391,000. The unemployment rate would shoot back up – an extremely plausible situation. A month of data is not extremely significant, given that last month we added 5 times as numerous jobs and crated substantially more jobs – holding the unemployment rate consistent. This can reverse extremely rapidly.

is not consistent and can have lots of incorrect alarms. Once these claims rise enough to supply a clear image, the economy is currently in

a recession and the marketplace has long fixed. We now bottomed out for a year, and it would be difficult to think we can preserve this much longer.< a href ="https://static.seekingalpha.com/uploads/2019/10/4/49279878-157023043590407_origin.png"rel=" lightbox"data-width="1455" data-height ="543"data-og-image-twitter_small_card= "real"data-og-image-twitter_large_card="true" data-og-image-twitter_image_post ="real"data-og-image-msn=" true"data-og-image-facebook="real"data-og-image-google_news= "true"data-og-image-google_plus="real"data-og-image-linkdin="real"itemprop="image"itemscope="true"itemtype="https://schema.org/ImageObject" > Initial claims of joblessness Other Indicators Other data, such as the manpower involvement rate, are not very useful in making financial predictions. They have substantial month-to-month variations and show no clear trends. Average hourly incomes information might provide some insight; however, not enough historical information is available. The recent downtrend is definitely noticeable. Average per hour earnings of All Employees: Total Private Bottom Line The unemployment rate dropped to 3.5% mainly due a smaller boost in the manpower relative to newly created jobs. The home study reveals fewer new tasks than last month. Frustrating payroll data is concerning, provided its more coincident nature as an indication.

If we have a month where the net addition of tasks surpass the boost in the labor force, the joblessness rate drops and vice versa. A month of information is not really significant, offered that last month we added five times as numerous tasks and crated considerably more jobs – holding the joblessness rate consistent. It is essential to note that the household study consists of a much bigger set of workers, but a smaller sized sample size with a very large margin of error. Payroll information normally declines a bit ahead of a recession compared to the joblessness rate, as can be seen from the charts above. The unemployment rate dropped to 3.5% generally due a smaller increase in the labor force relative to newly developed jobs.